2023 ushered in important changes to Medicaid eligibility for Seniors 65+ and people with disabilities.

If you’re curious about eligibility for yourself or a loved one, you’re in the right place! We’ll cover the key changes to Medicaid access right here.

There were two key changes to Medicaid eligibility in New York State that went into effect on January 1, 2023. We’ll cover those two changes, in addition to key benefits that come with your Medicaid eligibility. Here’s what you’ll learn:

1. Increased Medicaid Income Limit

2. Increased Medicaid Asset Limit

3. How New York State Differs from Other Programs

4. What Else Does Your Medicaid Eligibility Give You Access To?

Without further ado, here is everything you need to know about Medicaid eligibility in 2023.

Increased Medicaid Income Limit

The income amount for Medicaid eligibility was raised from 100% of the Federal Poverty Level (FPL) to 138% of the FPL. New York State includes the following as sources of income:

- Social security

- Retirement account distributions

- Pension

- Income payable from a trust

- Rental income

Conversely, some sources of income will be excluded: Veterans’ benefits, Workmen’s comp, and gifts or inheritances. People with these types of income may lose Medicaid, or have to spend-down, when they switch to non-MAGI Medicaid.

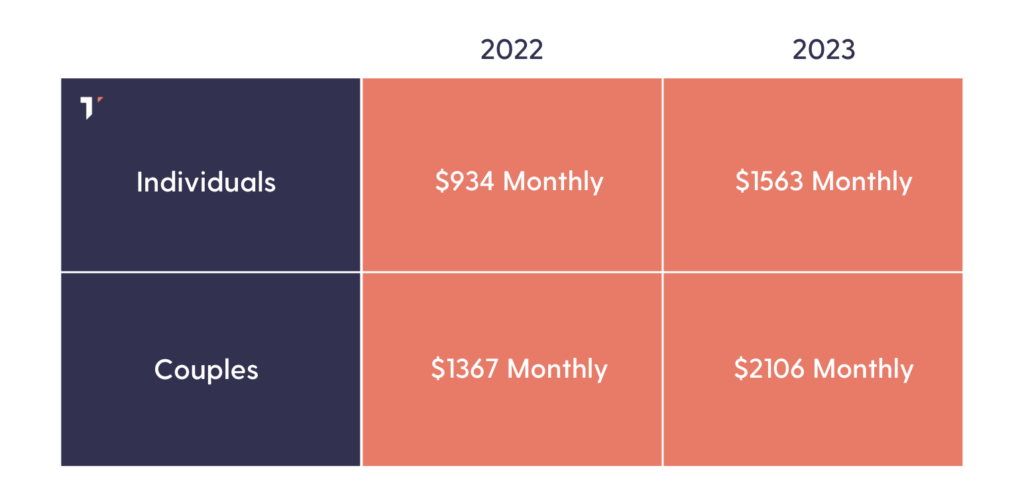

Exact income limits for Medicaid eligibility for individuals and couples are outlined below:

If your income is above the new limits, there are two ways to qualify for Medicaid long term.

- Spend down your excess income: The government requires you to “spend down” your excess income by subtracting medical expenses, including deductibles and premiums, to lower your monthly income to a level that qualifies you.

- Join a pooled income trust: To gain eligibility, you would deposit your monthly excess income into the trust, which can be used to pay qualified monthly bills.

Increased Medicaid Asset Limit

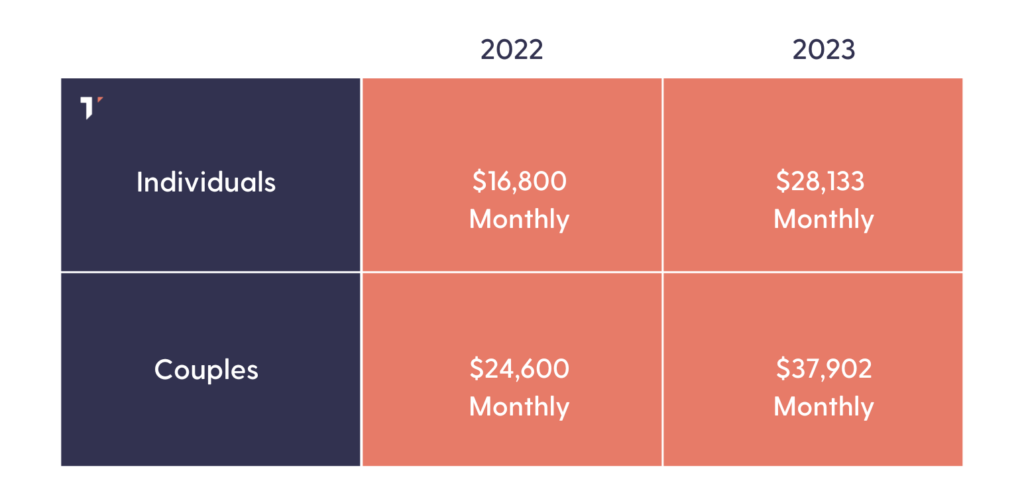

The second change to Medicaid eligibility is the allowable asset maximum limit. This is increasing by 50 percent in 2023.

This includes:

- Checking accounts

- Savings accounts

- Brokerage accounts

- CDs

- Non-qualified annuities

- Individual stocks

- Real estate (not primary residence)

- Cash surrender value of life insurance

This does not include:

- Tax-deferred retirement accounts

- Traditional IRAs and 401ks in payout status

The new asset levels are outlined below:

How Does New York State’s Medicaid Differ from Other Programs?

States establish and administer their own Medicaid programs. As a result, the populations and benefits covered by Medicaid vary from state to state.

A study conducted by Quote Wizard found that New York State provided the best Medicaid coverage in the country, followed by New Hampshire and Wisconsin. They used three factors to determine each state’s capacity to deliver the best Medicaid benefits:

- Cost of physician fee for service

- Medicaid funding per beneficiary

- Percentage of total funding by the state

What Else Does Your Medicaid Eligibility Give You Access To?

The NYS Medicaid program allows chronically ill or consumers with disabilities who need help with everyday activities to hire their own home care assistants. Consumers can choose their own caregiver, who may or may not be family members or friends.

This is known as the Consumer Directed Personal Assistance Program, or CDPAP. If you would like access to this program, Trusted Choice Homecare can help you navigate the assessments, forms and other steps you must take. Trusted Choice has been a Fiscal Intermediary for the New York State CDPA since November 2016. We can help, even if you aren’t signed up with Medicaid yet.

Enroll By Clicking Here!

Recent Comments